Disruption and transformation is all around us these days, prominent key note speakers at large summits bombarding us, large organisations that want to associate their brand with it and start-ups doing it each and every day as part of their everyday operations.

But the broad mass of organisations mainly consume insights, upcoming trends and do not act and nervously laugh along with colleagues and partners at summits and conferences across the globe. Defending their actions with: "Well this is not for us", "That is not part of our core offering.", "Inspiring but that would n e v e r apply to our industry"

"Inspiring but that would n e v e r ever apply to our industry"

Can they really afford neglecting it any longer?

What happens if one miss the first crucial opportunity and need to play a double catch-up race with at least twice the cost to begin with. If you are in business of any kind today, everything is questionable, ready to be disrupted or transformed from the core - really it is.

A good example to exemplify this, is what is currently happening in the field of traditional financial services and banking. A recent study shows that 1/3 of all bank jobs will be gone in a nearby future. That threat (or rather opportunity) is real. The disruption is digitalised advisory that is sharper, more accurate than its predecessors. User and customers are growing tired of constantly being mistreated with the bombardment of news relating to large financial institutions being part of organised tax planning and huge profits at their expense. The shift is real and one cannot lean against regulation and legislation forever.

Another evident example. I passed the EY head office in the central parts of Stockholm yesterday, on a small billboard it said:

"EY - Swedens best firm of accountants 2015."

No surprises there. But 20 meters further down the street where and ad-agency earlier was based something is going on:

It is the future head office of Dooer

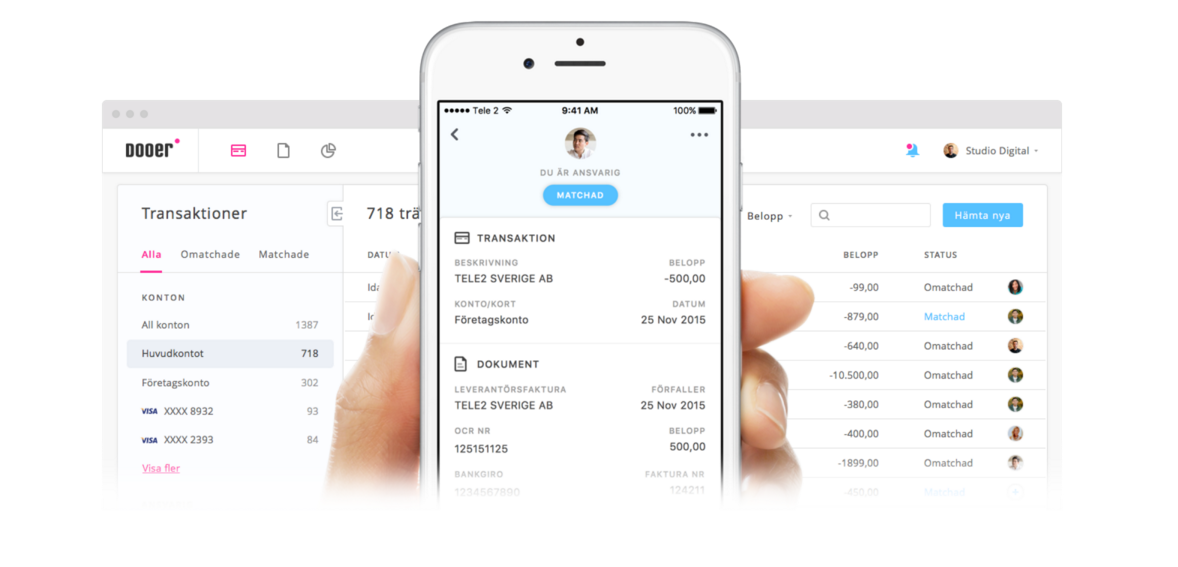

Dooer is a start-up company with focus on "Future of accounting". Target groups being both business owners both surprisingly also accountant firms. Beeing inclusive not exclusive is a key learning here.

The service automises accounting and eventually it will become and a AI (artificial intelligence) that will evolve over time making razor sharp tax deductions/planning etc in real time. Quicker and more efficient than its human predecessors. Opening its headquarters on the same street as EY might be coincidental (I think not) but a clear example of how disruption suddenly have landed on ones doorstep and there is very little to do about it other than embracing it and possibly be more innovative. Of course one could pull the traditional trick of acquiring the potential threat. I would advocate acquisition with open mindedness.

Be mindful, treat it as an possibility to transform your organisation by adding a innovative layer and continue to develop it by investing in the organisation, new processes and evidently the numerous of new customer needs that you will and can meet from here on out and you will never be done. Your business idea may need to transform but that's a reality for everyone nowadays.

Ever evolving will be your new mantra just as long you have identified a relevant direction for your company in correlation to the consumer and their needs.